The significance of ESG (Environmental, Social, Governance) factors in global finance trends sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve deeper into the realm of ESG factors and their impact on global finance trends, we uncover a fascinating intersection of environmental sustainability, social responsibility, and effective governance practices that are shaping the future of financial markets worldwide.

The Significance of ESG Factors in Global Finance Trends

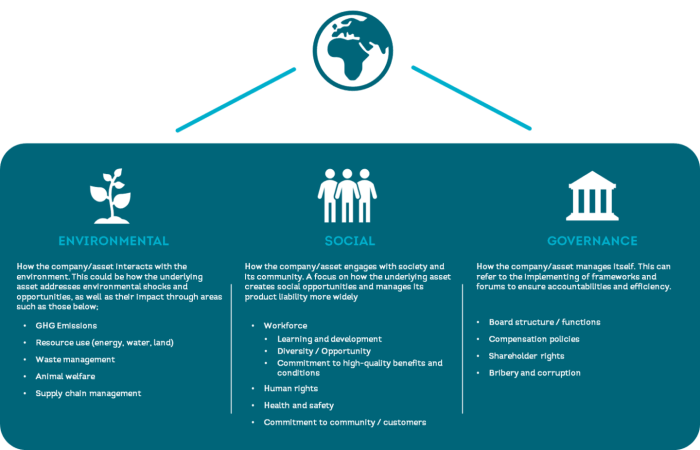

ESG factors, which stand for Environmental, Social, and Governance, play a crucial role in shaping the landscape of global finance. These factors are used by investors and financial institutions to evaluate the sustainability and ethical impact of potential investments.

Impact of ESG Factors on Investment Decisions

ESG factors have a direct influence on investment decisions as they provide a comprehensive view of a company’s operations beyond just financial performance. For example, companies with strong ESG practices are more likely to attract investment due to their sustainable business models and responsible corporate behavior.

- Companies that prioritize environmental sustainability are seen as less risky investments in the long run, as they are better equipped to adapt to changing regulations and consumer preferences.

- Socially responsible companies that prioritize employee well-being and community engagement tend to have higher employee retention rates and are better positioned to weather social crises.

- Good governance practices, such as transparent reporting and diverse board compositions, instill trust in investors and reduce the likelihood of corporate scandals or fraud.

Growing Importance of ESG Considerations in Global Financial Markets

ESG considerations are gaining prominence in global financial markets as investors increasingly recognize the importance of sustainable and ethical investing. This shift is driven by a growing awareness of the long-term risks associated with climate change, social inequality, and corporate misconduct.

Investors are realizing that companies with strong ESG practices are not only better positioned for long-term success but also contribute to positive social and environmental outcomes.

As a result, there is a growing demand for ESG-related financial products and services, such as ESG-focused mutual funds and green bonds. Regulatory bodies and stock exchanges are also starting to require companies to disclose their ESG performance, further emphasizing the significance of these factors in the global finance landscape.

Strategic Financial Efficient Money Moves

When it comes to managing finances, making strategic decisions is crucial for long-term success. These decisions can have a significant impact on your financial well-being and ability to achieve your goals.

Efficiently managing money involves more than just saving and budgeting. It requires a thoughtful approach to how you earn, spend, invest, and plan for the future. Financial planning plays a key role in ensuring that you are able to meet your financial objectives over time.

Importance of Budgeting and Saving

- Creating a budget helps you track your expenses and identify areas where you can cut back to save more money.

- Setting aside a portion of your income for savings can provide a financial safety net for unexpected expenses or emergencies.

- Regularly reviewing and adjusting your budget and savings goals ensures that you stay on track to meet your financial objectives.

Investing Wisely for the Future

- Investing allows your money to grow over time through the power of compound interest.

- Diversifying your investment portfolio helps spread risk and maximize returns.

- Regularly reviewing and rebalancing your investments ensures that your portfolio remains aligned with your financial goals.

Role of Financial Planning in Long-Term Goals

- Financial planning involves setting specific, measurable, achievable, relevant, and time-bound (SMART) goals to guide your decision-making.

- Creating a financial plan helps you prioritize your financial objectives and establish a roadmap for achieving them.

- Working with a financial advisor can provide you with expert guidance and help you navigate complex financial decisions.

Global Investing Insight

Investing globally offers a range of benefits, including portfolio diversification, access to new markets, and potential for higher returns. It allows investors to spread risk across different regions and industries, reducing the impact of local economic downturns on their investments.

Benefits of Global Investing

- Diversification: By investing in various markets, investors can reduce the risk associated with economic fluctuations in a particular country or region.

- Access to Growth Opportunities: Global investing provides access to emerging markets with high growth potential, offering opportunities for higher returns.

- Currency Diversification: Investing in different currencies can help hedge against currency risk and provide additional diversification.

Key Factors to Consider when Investing Globally

- Market Research: Conduct thorough research on global markets, industries, and companies before making investment decisions.

- Regulatory Environment: Understand the regulatory framework in different countries to assess the risks and opportunities involved.

- Risk Management: Implement risk management strategies to mitigate potential risks associated with global investments.

Impact of Geopolitical Events on Global Investments

- Geopolitical events such as trade wars, political instability, and conflicts can have a significant impact on global investments, leading to market volatility and uncertainty.

- Investors need to closely monitor geopolitical developments and assess their potential impact on their investment portfolios to make informed decisions.

- Geopolitical risks can create opportunities for savvy investors who are able to navigate and capitalize on market fluctuations caused by such events.

Daily Finance Tips

When it comes to managing your daily finances, it’s important to establish good habits that can help you budget effectively and save money over time. Small daily financial decisions can have a significant impact on your overall financial well-being, so it’s crucial to pay attention to your spending and saving habits.

Practical Budgeting Tips

- Track your expenses: Keep a record of every expense, no matter how small, to get a clear picture of where your money is going.

- Create a budget: Set spending limits for different categories like groceries, entertainment, and bills to avoid overspending.

- Avoid impulse purchases: Think twice before making a purchase to determine if it’s a necessity or a want.

- Automate savings: Set up automatic transfers to a savings account to ensure you’re consistently putting money aside.

Importance of Small Daily Financial Habits

- Compound effect: Small savings and smart spending decisions can add up over time to create significant financial growth.

- Financial discipline: Developing good daily financial habits can help you build discipline and resilience in managing your money.

- Emergency fund: By saving a little every day, you can gradually build an emergency fund to cover unexpected expenses.

- Long-term financial goals: Consistent daily financial habits can help you achieve your long-term financial goals, such as buying a house or retiring comfortably.

Financial Planning

Financial planning is crucial for both individuals and businesses as it helps in setting clear financial goals, managing resources efficiently, and ensuring financial stability for the future.

The Importance of Financial Planning

- Financial planning provides a roadmap for achieving long-term financial goals.

- It helps in identifying potential risks and challenges that may impact financial well-being.

- By creating a budget and sticking to it, financial planning ensures proper allocation of funds for various needs.

- It enables individuals and businesses to save and invest wisely for future growth and security.

Strategies for Creating a Solid Financial Plan

- Evaluate your current financial situation by analyzing income, expenses, assets, and liabilities.

- Set specific, measurable, achievable, relevant, and time-bound (SMART) financial goals.

- Create a budget that aligns with your goals and helps in monitoring spending.

- Consider diversifying investments to minimize risks and maximize returns.

How Financial Planning Can Help Achieve Financial Goals

- Financial planning provides a structured approach to reaching financial milestones.

- It helps in prioritizing financial objectives and making informed decisions based on available resources.

- Regular monitoring and adjustments to the financial plan ensure progress towards goals.

- By staying disciplined and following the plan, individuals and businesses can achieve long-term financial success.

PERSONAL FINANCE MINDSET

Developing a positive mindset when it comes to personal finance is crucial for successful financial management. Your mindset can greatly impact your financial decisions and ultimately determine your financial success. Here are some tips for cultivating a positive financial mindset:

Mindset Tips for Personal Finance

- Acknowledge your beliefs about money: Take some time to reflect on your beliefs and attitudes towards money. Identify any negative beliefs that may be holding you back from making sound financial decisions.

- Set clear financial goals: Define your financial goals and create a plan to achieve them. Having clear objectives will help you stay motivated and focused on your financial journey.

- Practice gratitude: Cultivate a mindset of gratitude for what you have rather than focusing on what you lack. Gratitude can help shift your perspective towards abundance and attract more positive financial outcomes.

- Stay informed and educate yourself: Keep yourself informed about financial matters and continuously educate yourself on personal finance topics. Knowledge is power when it comes to making informed financial decisions.

- Avoid comparison: Instead of comparing your financial situation to others, focus on your own progress and financial goals. Comparison can lead to negative emotions and cloud your financial judgment.

Future Finance Experts

In today’s rapidly evolving financial landscape, the role of future finance experts is more crucial than ever. These professionals are expected to possess a unique set of skills and knowledge to navigate the complexities of the industry and stay ahead of emerging trends.To become a future finance expert, individuals need to have a strong foundation in finance, accounting, economics, and other related fields.

Proficiency in data analysis, critical thinking, problem-solving, and communication is also essential. Moreover, keeping up-to-date with the latest technologies and industry developments is vital to thrive in this competitive environment.

Skills and Knowledge Required

- Proficiency in financial analysis and modeling

- Understanding of risk management and compliance

- Knowledge of regulatory frameworks and policies

- Ability to interpret and communicate complex financial information

- Strong ethical standards and integrity in decision-making

Emerging Trends in Finance Industry

- Integration of artificial intelligence and machine learning in financial services

- Rise of sustainable and impact investing

- Growing importance of cybersecurity in financial institutions

- Shift towards digital payments and blockchain technology

- Increased focus on diversity, equity, and inclusion in finance

Preparing for a Career in Finance

- Pursue relevant education and certifications in finance

- Gain practical experience through internships and entry-level positions

- Build a strong professional network in the finance industry

- Stay informed about industry trends and developments

- Continuously enhance your skills through training and professional development opportunities

Sustainable Finance

Sustainable finance refers to the integration of environmental, social, and governance (ESG) criteria into financial decision-making processes. It focuses on investing in companies and projects that promote long-term sustainable growth while considering the impact on society and the environment.

Importance of Sustainable Finance

- Encourages responsible investing practices that align with environmental and social values.

- Promotes long-term economic stability by addressing sustainability challenges.

- Drives innovation and efficiency in industries towards more sustainable practices.

Examples of Sustainable Finance Initiatives

- Green bonds: These are bonds specifically issued to finance projects that have positive environmental or climate impacts.

- Social impact investing: Investing in companies or projects that generate measurable social or environmental benefits alongside financial returns.

- ESG integration in investment decisions: Incorporating ESG factors into investment analysis to identify risks and opportunities related to sustainability.

Role of Sustainable Finance in Addressing Environmental Challenges

Sustainable finance plays a crucial role in addressing environmental challenges by directing capital towards sustainable solutions and environmentally friendly projects. By promoting sustainable practices and investments, it helps mitigate climate change, reduce carbon emissions, and protect natural resources for future generations.

Tech-driven Finance

In today’s rapidly evolving financial landscape, technology plays a crucial role in shaping the industry. From digital innovations to disruptive fintech solutions, the impact of technology on finance cannot be overstated.

Digital Innovations in Finance

- Blockchain Technology: Blockchain has revolutionized the way transactions are recorded and verified, increasing transparency and security in financial transactions.

- Artificial Intelligence: AI-powered algorithms are being used for risk assessment, fraud detection, and personalized financial recommendations, enhancing efficiency and accuracy in decision-making.

- Robo-Advisors: Automated investment platforms provide cost-effective and convenient investment solutions, making wealth management more accessible to a wider audience.

Transformation of Financial Services

- Mobile Banking: The rise of mobile banking apps has transformed the way consumers manage their finances, offering convenience and flexibility in banking services.

- Peer-to-Peer Lending: Online platforms connect borrowers directly with lenders, bypassing traditional financial institutions and providing alternative financing options.

- Digital Payments: Contactless payments, mobile wallets, and cryptocurrencies are reshaping the way transactions are conducted, emphasizing speed, security, and convenience.

Financing Innovation

Innovation plays a crucial role in the financial sector, driving progress and shaping the industry’s future. It enables financial institutions to develop new products, services, and solutions that cater to the evolving needs of customers and the market.

Importance of Innovation in Finance

Innovation in finance is essential for staying competitive and meeting the ever-changing demands of consumers. By embracing new technologies and creative strategies, financial institutions can streamline processes, improve efficiency, and enhance customer experience. This ultimately leads to increased profitability and sustainable growth.

- Development of Fintech Solutions: Fintech companies are revolutionizing the way financial services are delivered, making transactions faster, more secure, and convenient for users.

- Enhanced Risk Management: Innovative financial tools help institutions better assess and mitigate risks, ensuring the stability and security of the financial system.

- Improved Accessibility: Innovations such as mobile banking and digital wallets have made financial services more accessible to a wider range of people, including those in underserved communities.

Examples of Successful Financial Innovations

Peer-to-peer lending platforms like Lending Club have disrupted traditional lending models, connecting borrowers directly with investors and offering more competitive rates.

- Cryptocurrency: The rise of digital currencies like Bitcoin has created new investment opportunities and challenged the traditional banking system.

- Robo-Advisors: Automated investment platforms use algorithms to provide personalized financial advice and manage portfolios, offering cost-effective solutions for investors.

- Blockchain Technology: The decentralized and secure nature of blockchain has the potential to revolutionize various financial processes, such as cross-border payments and smart contracts.

Financial Tips

In today’s fast-paced world, making smart financial decisions is crucial to securing your financial future. Whether it’s managing debts, making investments, or improving your financial literacy, following practical tips can help you navigate the complex world of finance with confidence.

Managing Debts

When it comes to managing debts, it’s essential to prioritize high-interest debts first. By paying off debts with the highest interest rates, you can save money in the long run. Additionally, consider consolidating your debts or negotiating with creditors to lower interest rates and create a feasible repayment plan.

Making Investments

Investing can be a powerful tool for building wealth, but it’s essential to approach it with caution. Diversifying your investment portfolio can help spread risk and maximize returns. Research different investment options, seek advice from financial experts, and regularly review your investments to ensure they align with your financial goals.

Financial Literacy

Financial literacy is the foundation of making informed financial decisions. Educate yourself on basic financial concepts, such as budgeting, saving, and investing. Take advantage of financial literacy resources, attend workshops, and seek guidance from financial advisors to enhance your financial knowledge and make sound financial choices.

Finance Solutions

When it comes to managing finances, individuals and businesses have access to a variety of solutions to address their specific needs and goals. Financial institutions play a crucial role in providing these solutions, offering a range of products and services to help clients achieve financial success.

Let’s explore some of the innovative finance solutions available in the market today.

Role of Financial Institutions

Financial institutions play a critical role in providing financial solutions to individuals and businesses. They offer a wide range of products and services, including savings accounts, loans, investment options, and insurance products. These institutions help clients manage their finances effectively and make informed decisions about their money.

Examples of Innovative Finance Solutions

- Peer-to-peer lending platforms that connect borrowers directly with investors, cutting out traditional financial institutions.

- Robo-advisors that use algorithms to provide automated investment advice and portfolio management at a lower cost than traditional financial advisors.

- Blockchain technology for secure and transparent transactions, revolutionizing the way financial transactions are conducted.

- Microfinance initiatives that provide small loans to entrepreneurs in developing countries, empowering them to start and grow their businesses.

Personal Finance Mastery

Personal finance management is crucial for achieving financial stability and success. By mastering the basics of personal finance, individuals can make informed decisions to secure their financial future.

Tips for Mastering Personal Finance Management

- Track your expenses: Create a budget to monitor your spending habits and identify areas where you can cut back to save more money.

- Set financial goals: Establish short-term and long-term financial goals to stay motivated and focused on your financial objectives.

- Build an emergency fund: Save money in an emergency fund to cover unexpected expenses and avoid going into debt.

- Invest wisely: Educate yourself on different investment options and consider working with a financial advisor to develop a diversified investment portfolio.

- Stay informed: Keep up-to-date with financial news and trends to make informed decisions about your money.

Strategies for Improving Financial Literacy

- Take financial literacy courses: Enroll in online courses or attend workshops to enhance your knowledge of personal finance concepts.

- Read financial books: Explore books written by financial experts to deepen your understanding of money management and investing.

- Use financial apps: Utilize budgeting apps and tools to track your finances, set financial goals, and improve your financial literacy.

Building a Strong Financial Foundation

- Pay off high-interest debt: Prioritize paying off high-interest debt to reduce financial stress and free up money for savings and investments.

- Create multiple income streams: Explore opportunities to generate additional income through side hustles, freelance work, or passive income streams.

- Plan for retirement: Start saving for retirement early by contributing to retirement accounts like 401(k)s or IRAs to secure your financial future.

Global Finance Trends

Global finance trends are constantly evolving, influenced by various factors such as economic conditions, technological advancements, and regulatory changes. These trends shape the way financial markets operate and impact investment decisions on a global scale.

Impact of Globalization on Financial Markets

Globalization has played a significant role in shaping financial markets by increasing interconnectedness among economies, facilitating cross-border capital flows, and providing access to a wider range of investment opportunities. This has led to greater market efficiency, increased competition, and enhanced diversification for investors.

However, globalization has also exposed financial markets to risks such as volatility, contagion effects, and regulatory challenges. It is important for market participants to closely monitor and adapt to these dynamics to navigate the complexities of global finance.

Future Trends in Global Finance

As we look ahead, several key trends are expected to impact the global finance landscape. These include the rise of sustainable finance and ESG investing, advancements in financial technology (fintech) and digitalization, shifting regulatory frameworks, and the increasing influence of emerging markets.

Embracing innovation, promoting transparency, and fostering responsible investing practices will be crucial for navigating the future of global finance successfully. By staying informed and adaptable, investors and financial institutions can position themselves strategically to capitalize on emerging opportunities and manage risks effectively.

Green Financing

Green financing is a type of financing that specifically supports projects and initiatives that have positive environmental impacts. This approach involves investing in activities that contribute to sustainability, such as renewable energy projects, energy-efficient buildings, and waste management solutions. Green financing plays a crucial role in addressing environmental challenges and promoting a more sustainable future.

Benefits of Green Financing

- Reduces carbon footprint: Green financing helps reduce greenhouse gas emissions and mitigate climate change by supporting projects that are environmentally friendly.

- Cost savings: Investing in green initiatives can lead to long-term cost savings through energy efficiency and sustainable practices.

- Enhances corporate reputation: Companies that engage in green financing are often seen as environmentally responsible, which can improve their reputation among consumers and investors.

Examples of Green Finance Initiatives

- Green bonds: These are fixed-income securities issued to raise capital for projects with environmental benefits, such as renewable energy or clean transportation.

- Sustainable loans: These are loans provided to fund projects that meet environmental or social sustainability criteria, encouraging businesses to adopt more sustainable practices.

- Green mortgages: These are home loans that offer incentives for energy-efficient homes or properties with green certifications, promoting sustainable living.

Role of Green Financing in Promoting Sustainability

- Encourages innovation: Green financing drives innovation in renewable energy, sustainable infrastructure, and other eco-friendly solutions by providing financial support to projects in these areas.

- Fosters sustainable development: By channeling funds into environmentally beneficial projects, green financing contributes to the achievement of sustainable development goals and helps create a more sustainable future for all.

- Aligns with ESG principles: Green financing aligns with Environmental, Social, and Governance (ESG) criteria, ensuring that investments consider not only financial returns but also their impact on the environment and society.

Ending Remarks

In conclusion, the discussion around the significance of ESG factors in global finance trends highlights the critical need for businesses and investors to prioritize sustainability, social impact, and strong governance principles in their decision-making processes. As we navigate the complex landscape of finance, the integration of ESG considerations will undoubtedly play a pivotal role in driving positive change and fostering long-term financial stability on a global scale.

Common Queries

What are ESG factors and why are they important in finance?

ESG factors refer to environmental, social, and governance criteria that help evaluate a company’s ethical impact and sustainability practices. They are crucial in finance as they provide valuable insights into a company’s long-term performance and risk management strategies.

How do ESG factors influence investment decisions?

ESG factors can influence investment decisions by helping investors assess the overall sustainability and societal impact of a company. Companies with strong ESG practices are often viewed more favorably by investors seeking to align their investments with ethical and sustainable principles.

What is the significance of ESG considerations in global financial markets?

ESG considerations are increasingly important in global financial markets as they reflect a shift towards more responsible investing practices. Integrating ESG factors into decision-making processes can lead to better risk management, improved long-term performance, and positive societal impact.